How to recover outstanding accounts receivable in 6 easy steps

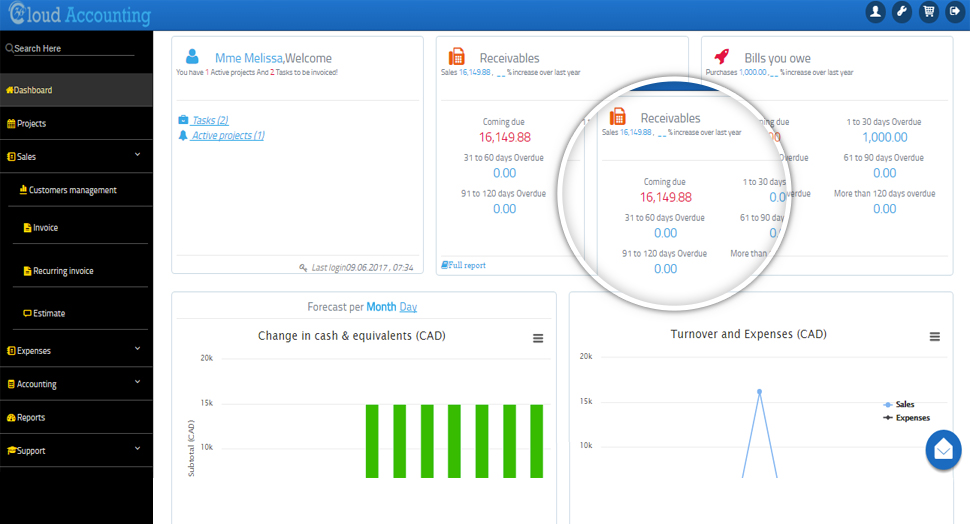

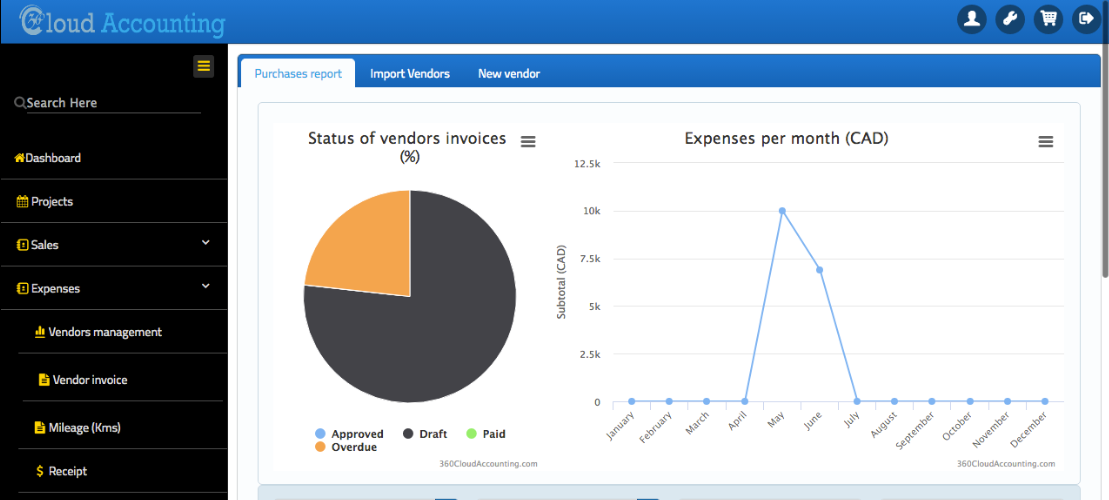

Is your business struggling with collecting late or unpaid invoices? Do your financial reports look like this?

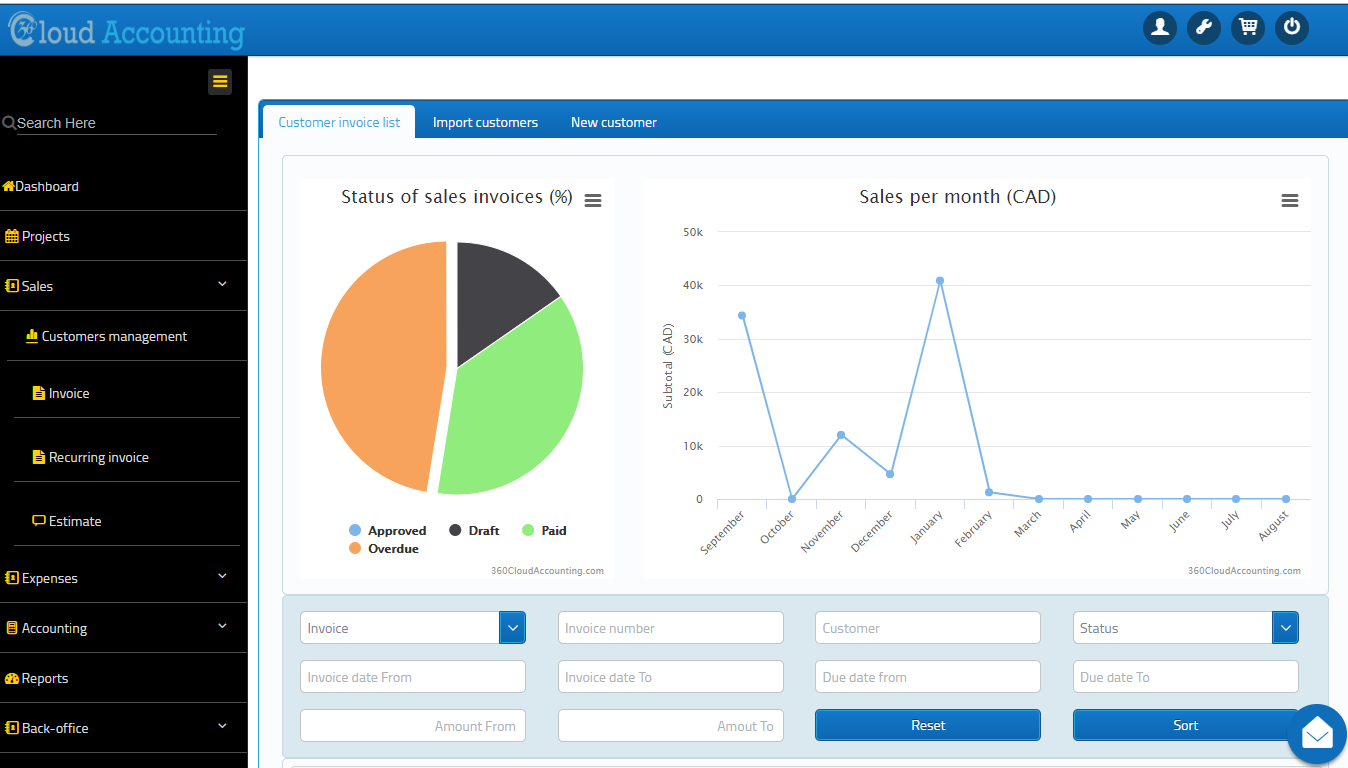

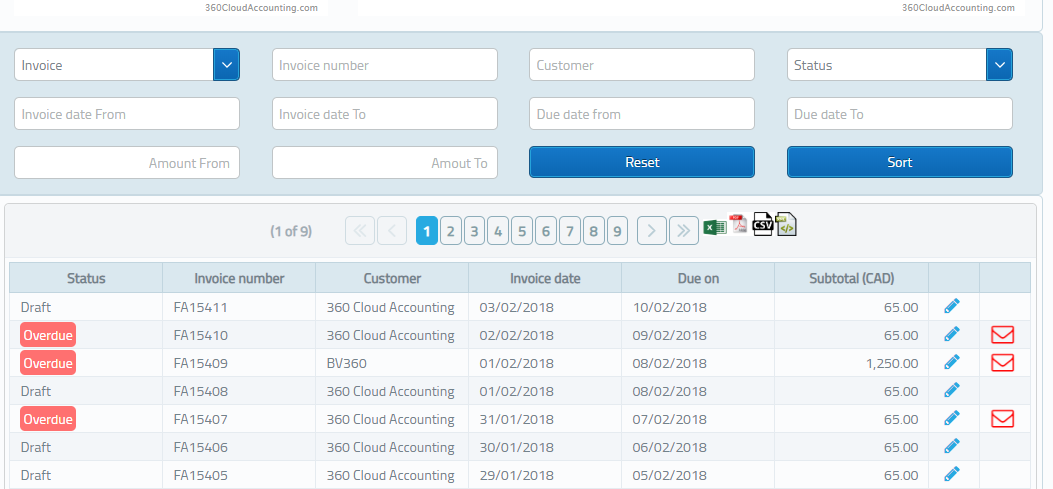

...instead of this?

Many businesses face issues with accounts receivable collection and invoicing regardless of their size. Those who fail to replace their late paying customers and have trouble with tech delivery can't generate revenue or identify the inefficiencies in their process.

In these difficult times, effective accounts receivable management is more important than ever—an activity that plays a crucial role in the survival and sustainability of each company.

So, what are the best-in-class companies doing to prevent and recover overdue accounts? Below are six steps you can take today to maximize your cash flow and optimize your company's performance.

1. Bill as soon as possible

The recovery of unpaid invoices is a race against time. Timely invoice payments are key to maximizing your cash flow.

Using a cloud accounting software like 360 Cloud Accounting allows you to manage invoices, track expenses and access your finances at anytime from any device.

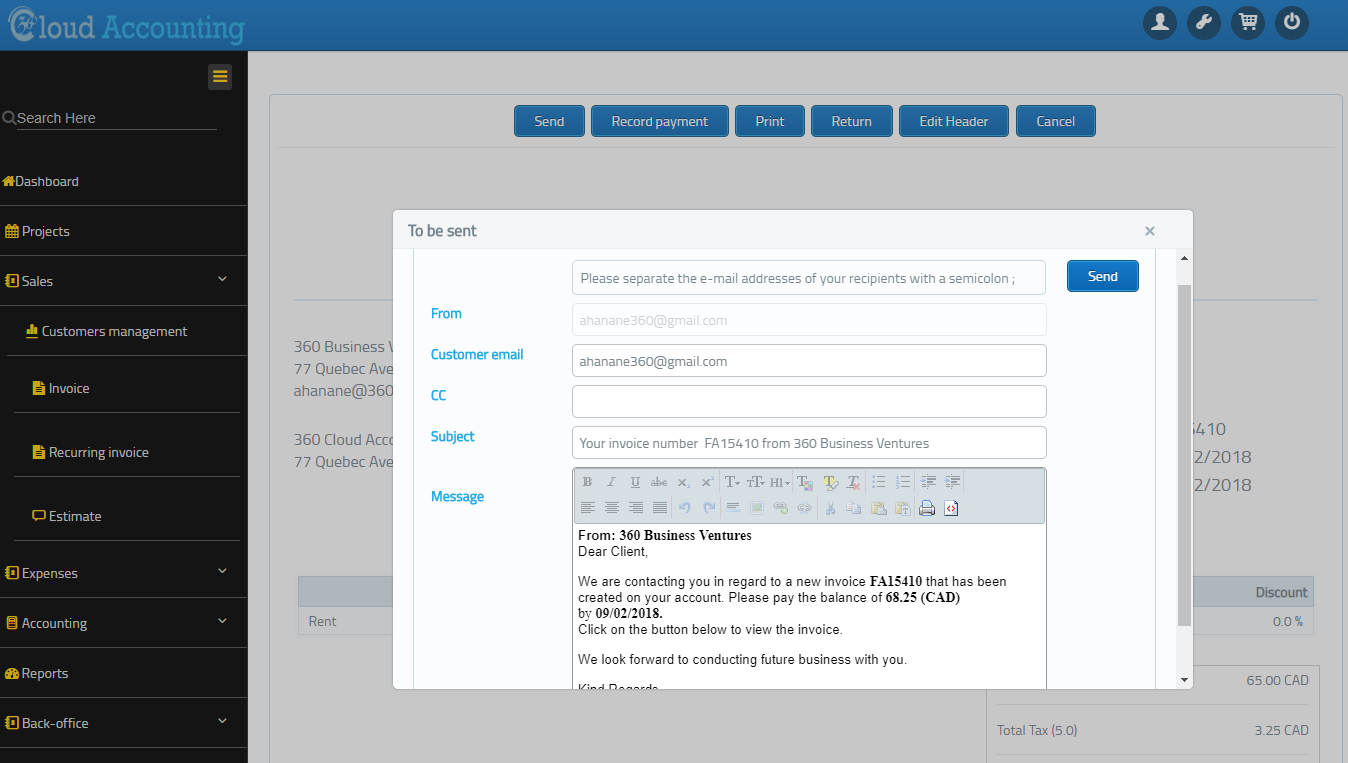

2. Send invoices electronically

Make sure that your invoices are sent promptly and electronically to avoid overdue accounts. Effective management of receipts, proofs of delivery and purchase orders, along with backup copies and supporting documents, are key to improving debt recovery.

Often, customers will ask for proofs of delivery and other paperwork such as purchase orders. Your ability to provide the requested documents in a timely manner in these instances is a testament to your operational efficiency. 360 Cloud Accounting gives you instant and remote access to these documents. With an automated accounts receivable system, the time typically spent in searching, locating and sending receipts and proofs of payment is immediately minimized.

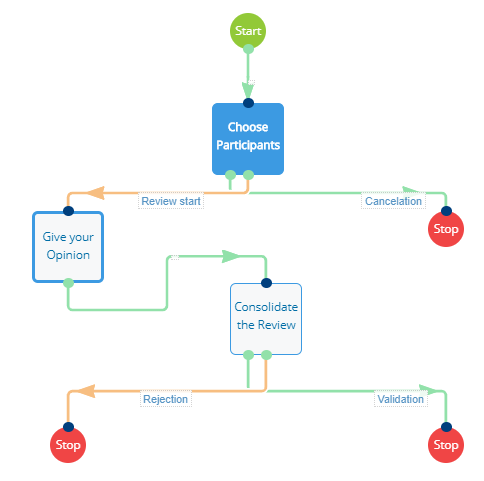

3. Manage the customer’s return effectively

Any feedback, rejection or suggestions for improvement must be computerized and efficiently managed. Processing a customer’s feedback in minutes with an Enterprise Content Management (ECM) solution like e-Doc360 can boost cash flow and save your company additional costs.

4. Automate and capitalize on IT solutions

Of course, there are many IT solutions in the market that allow you to optimize your processes and improve outstanding receivables, but only a few that improve the tracking of your past receivables. 360 Cloud Accounting generates automatic reminders when a late payment is detected and can easily track the history of late fees and unpaid invoices.

Check out our guide on records management for more information on leveraging IT solutions where it can best add value.

5. Adopt a rigorous credit management policy

It’s necessary to adopt an effective recovery strategy to tackle customer risk assessments, credit limit management and process control. To avoid cash flow interruptions, a distinction must be made between those who can pay and those who don’t intend on paying.

6. Measure accounts receivable performance

It’s often been said that you can’t manage what you can’t measure. In accounts receivable, generating and tracking KPIs with daily and permanent-based monitoring is essential to your company’s success. Automating your manual accounts receivable processes will uncover your company’s inefficient practices and in turn, maximize your ROI and sustain its value over time.

Conclusion

Whether you’re looking to extract data, scan files, automatically classify documents or electronically manage your records and content, 360 Business Ventures can equip your organization with the best platform, tools and practices required to spearhead your business’ growth and success.

Turn your receipts, invoices and statements into meaningful information and benefit from automating your accounts receivable with 360 Business Ventures.